Costa Rica and Panama take steps to create the first chip hub in Central America

Table of Contents

Contact the Central American Group to explore the foreign investment option in Costa Rica and to establish nearshore manufacturing operations in the Green Park Free Zone.

After the advent of the shortage of semiconductors in the world generated by the COVID-19 pandemic, the chip industry is experiencing an improvement. This circumstance is thanks to the different investments and alliances between countries since 2022 and so far in 2023. Two countries have been particularly active in taking measures to create a chip hub in Central America.

The United States supports the creation of a chip hub in Central America

Central America is not immune to this recovery. The United States announced a series of agreements with Costa Rica and Panama to promote chip manufacturing in this region. Although it will benefit the northern nation by diversifying its supply chain and contributing to the supply of chips for its critical manufacturing sectors, it is also positive for the entire region. This is because, in addition to generating more significant investment, it will create jobs, facilitate the exchange of technology and knowledge, and incentivize universities to develop careers focused on this industry.

The United States thinks that Costa Rica and Panama will help increase and diversify the global semiconductor ecosystem, which is why it allocated $1 billion to develop chips in both nations to create a chip hub in Central America. The US government has said that the two countries of the isthmus will contribute to creating a global semiconductor value chain that is more resilient, secure, and sustainable.

This may raise the idea of positioning these two countries as a ‘ semiconductor hub ‘ worldwide and not only in Latin America, thanks to the International Fund for Innovation and Technological Security (ITSI Fund), created by the United States Chip law.

The United States presented the Chips and Science Law Act, which is a $ 280 billion program over the next few years. Fifty-two billion dollars of this total amount will go toward improving semiconductor manufacturing.

The alliances announced in July 2023 with Costa Rica and Panama show that Central America will be a crucial player in the manufacturing of semiconductors, thus positioning the isthmus region as a nascent global chip concentrator.

The United States was able to take into account various factors to allocate 500 million dollars to both Panama and Costa Rica. These two countries’ transportation connectivity, economic growth, business climate, and trained human capital make the nations a potential chip hub in Central America.

From the perspective of PROPANAMA, the canal country has favorable conditions to attract global investments since it has a stable political, social, and economic environment and excellent digital and transportation connectivity with the continent’s main markets: the United States, Canada, Brazil, Mexico, and Colombia.

The Ministry of Foreign Affairs of Panama highlights the geographical position of the country in the center of the American continent as one of the most important logistics centers in the Western Hemisphere for the transshipment of goods. It has the special regime of Multinational Company Headquarters (SEM).

In the case of Costa Rica, an investment guide issued by the country’s central government refers to a business climate based on a recognized tradition of democracy and economic and political stability. It also points out that more than 90% of the energy utilized in Costa Rica is renewable. The country does not impose limitations on transfers of capital funds associated with an investment, regardless of currency.

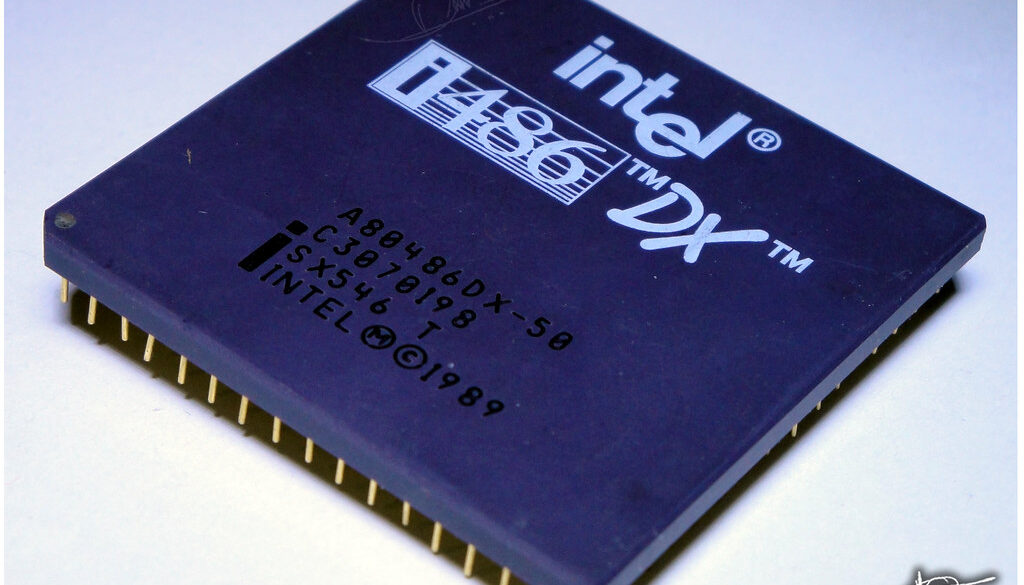

The president of the Chamber of Information and Communication Technologies of Costa Rica (CAMTIC), Paul Fervoy, considers that one of the reasons the United States decided to make this alliance to create a chip hub in Central America is that the nation already has experience in the semiconductor industry. In November 1996, Intel established a factory in Costa Rica to assemble and test microprocessors.

“Costa Rica was introduced to the world of processors in the non-sale years when Intel decided to install one of its microprocessor plants there,” says Fervoy.

Both Central American nations have great economic indicators for attracting foreign investment and GDP growth. Panama is expected to be the growth engine of the region, with an estimated 4.6% at the end of 2023, while Costa Rica will have a GDP of 2.7%.

The two countries are the largest recipients of foreign direct investment (FDI). Costa Rica is in first place in 2022 with 3.7 billion dollars. Panama registered an FDI of 2.5 billion dollars that year.

In the case of Costa Rica, FDI is essential to its global positioning. The Greenfield FDI Performance Index, produced by fDi Intelligence, reveals that Costa Rica has the largest foreign direct investment in the world compared to its Gross Domestic Product (GDP).

In addition, Panama is positioned as the most favorable country to establish multinationals in Latin America, according to a review by the regulatory expert company Mercator in its LATAM Entity Portfolio Management.

A chip hub in Central America with a multiplier effect

Semiconductor industry experts believe that both countries will benefit from the alliance with the United States because there will be greater foreign investment and job creation, but, above all, because it will position the nations as a chip hub in Central America.

Regarding investment, PROPANAMA anticipates that the semiconductor industry will generate 5 billion dollars as a result of the semiconductor plants and the entire value chain: “The projected investment would not only contribute to the sustainable economic growth of Panama but would also reinforce its profile on the international scene as an attractive destination for technological investment and semiconductor manufacturing,” opines Carmen Gisela Vergara, general administrator of the organization.

The entity focused on attracting investment in Panama estimates that around 10,000 jobs can also be generated, both direct and indirect, which would transform the workforce and quality of life in the country.

“Direct jobs would be concentrated in semiconductor factories and cover various specialized areas such as design, engineering, manufacturing, and management. On the other hand, indirect jobs would be created in related sectors, such as distribution, construction, and services,” highlights Vergara.

In that same sense, the director of Investment Climate of the Costa Rican Investment Promotion Agency (CINDE), Vanessa Gibson, estimates that “there will be a positive impact in that country, not only because of the investments that may arrive,” because it is expected that there will also be growth in the operations of companies already established in the country.

A success story

November 13, 1996, is a milestone for attracting foreign investment in Costa Rica. On that date, the technology company Intel announced its decision to establish a factory in the country to assemble and test microprocessors. At that time, it was established as the foreign company with the largest investment registered in Costa Rica, with an initial amount of capital totaling 115 million dollars.

By 1999, Intel had already invested $390 million and had hired more than 2,200 workers with salaries higher than the national average in the manufacturing sector, reveals the study Moving Up the Global Value Chain: The Case of Intel Costa Rica, prepared by the International Labor Organization (ILO).

“For an economy (Costa Rica) with a production of 13 billion dollars in 1997 and a workforce slightly greater than one million people, without a doubt, Intel ‘s investment was an extraordinary investment,” the document highlights.

However, in 2014, the global firm announced that it would stop manufacturing semiconductors in Costa Rica. This occurred after 17 years and an investment of 900 million dollars.

Brian Krzanich, who served as CEO of Intel at the time, maintained that this decision was not part of the plans to reduce the company’s global workforce “but rather had more to do with the cost of that operation.”

But in August 2022, Intel officially inaugurated the Assembly and Test Plant at its facilities in San Antonio de Belén, Costa Rica, as part of the company’s 25th-year celebration in the country.

“Costa Rica is an appropriate location for this important expansion of our assembly and testing operations. The work we do here is critical to rebalancing the global semiconductor supply chain and supplying the industry with much-needed chips,” said Intel CEO Pat Gelsinger during the complex’s inauguration. Since 2020, the company’s investment in Costa Rica reached nearly $ 1 billion.

“Today, Intel Costa Rica has the largest and most complex operation in the last 26 years: more than 3,300 employees, nearly 5,000 contractors, 26,000 m2 of plant, and 1,000 m2 of laboratories for multiple software, hardware, and platform engineering operations. In addition, it has “the most specialized corporate services center to date,” explains Ileana Rojas, Global Vice President of Design Engineering and General Manager of the firm.

Ileana Rojas considers Costa Rica critical for producing semiconductors worldwide. It is a part of the chip hub in Central America because a more geographically balanced, resilient, and secure supply chain is needed. The American firm indicates that it is working so that the global semiconductor supply chain is balanced, with 50% in the Americas and Europe and another 50% in Asia.

The president of CAMTIC, Paul Fervoy, highlights the role of Intel in Costa Rica because although it left the manufacturing of semiconductors for a time, it opted for research and development, as well as design.

Has the crisis come to an end?

Global semiconductor sales exceeded $600 billion in 2022, and the sector is expected to expand again in 2023. In terms of segments, memory and analog chips continue to lead market growth, according to an analysis conducted by Statista.

The semiconductor industry is one of the most important in the world, and its growth has been constant in recent years. Installing a chip hub in Central America will do much to ensure its growth and stability.

In 2022, the global share of these components generated a value of 550 billion dollars. This figure is expected to grow at a compound annual rate (CAGR) of 8.6% between 2022 and 2030, data from PROPANAMA show.

Despite these projections, data from the World Semiconductor Trade Organization Statistics (WSTS) show that semiconductor companies invoiced $119.5 billion in the first quarter of 2023, which is 8.7% less than between October and December 2022.

“This is due to the cyclical nature and macroeconomic difficulties,” explains the Semiconductor Industry Association.

Different consulting firms such as IDC and Gartner consider that short-term supply has begun to exceed demand. Deloitte points out that the global chip industry is experiencing shortages and excess supply simultaneously. This is because while most of the supply chain for chips for cell phones, personal computers, and data centers is recovering, there are other sectors, such as automotive, that continue to suffer.

In that sense, IDC predicts that the industry will contract by 5.3% in 2023, while Gartner estimates a drop of 3.6%, and WSTS predicts it will be 4.1%.

But both digitalization and the energy transition that are both in full swing will boost demand, so the arrival of investment in Costa Rica and Panama will bring benefits in many ways and, above all, it is the starting point for Central America to emerge as a hub for the production of semiconductors in the world.

Source: Forbes Latin America

Contact Us

Please use this form to contact us and we will respond as soon as possible: