Doing Business in

Costa Rica

One of the most investment friendly countries in the Americas.

Investing in Costa Rica?

Download the presentation.

If you wish to download the presentation you can do it here.

Doing business in Costa Rica is best done in the Green Park Foreign Trade Zone

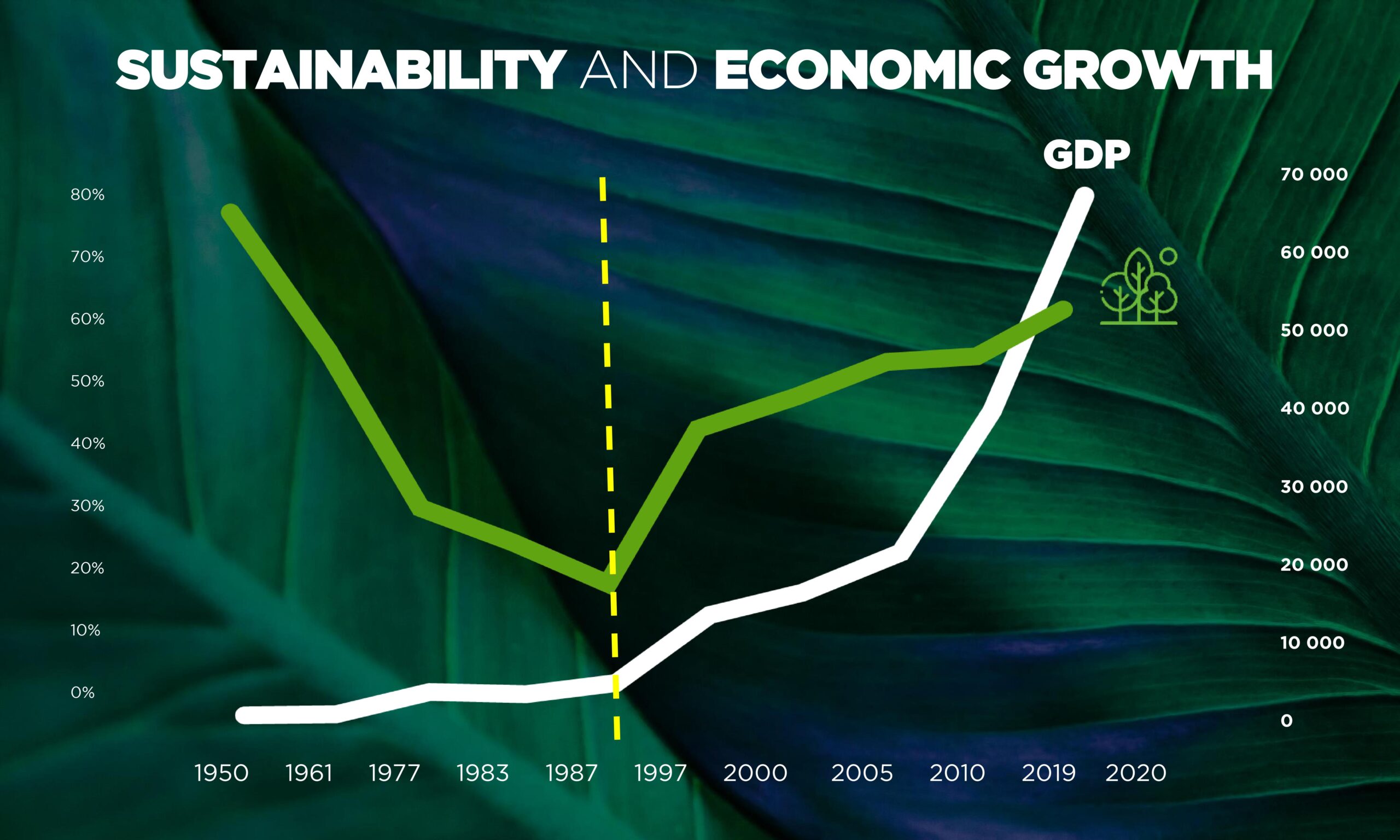

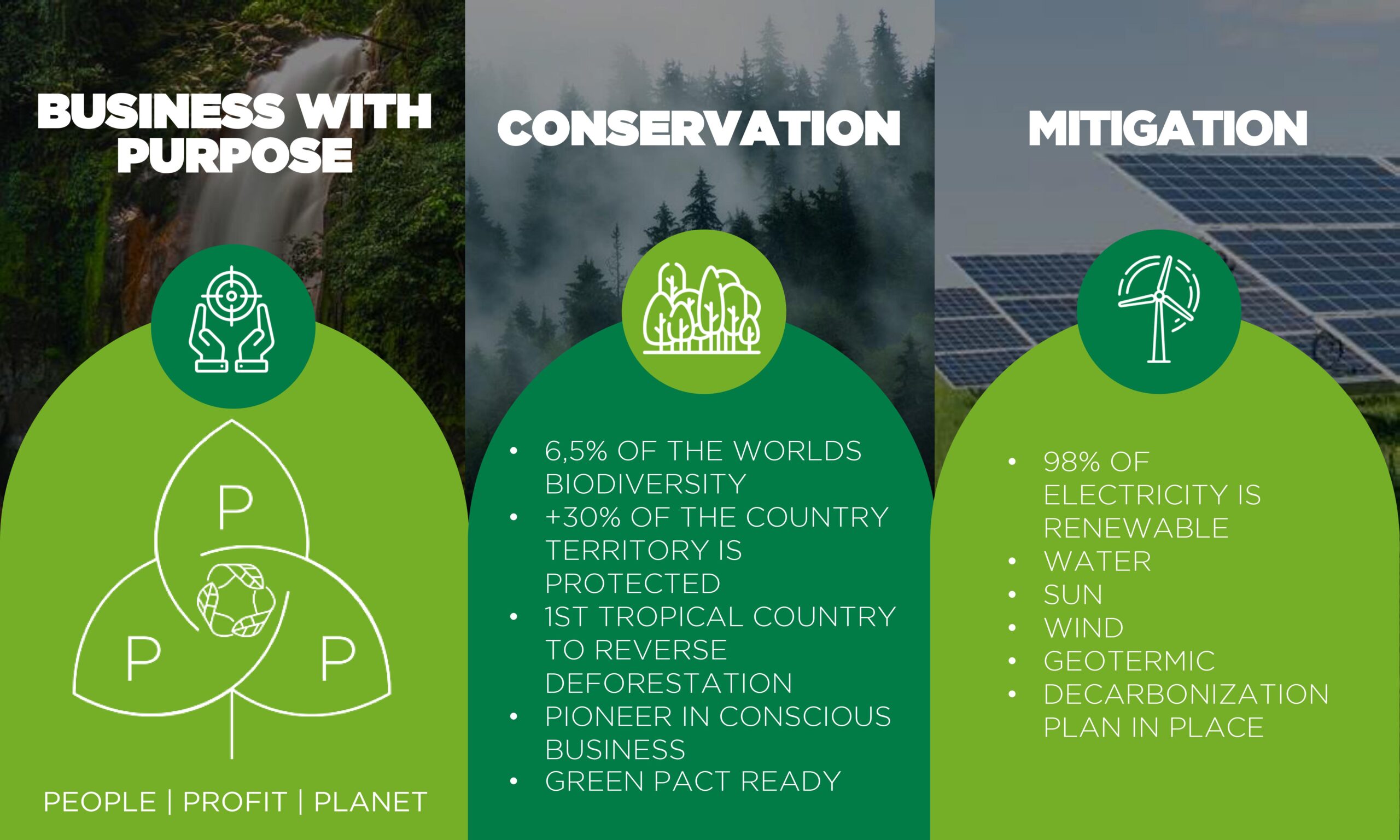

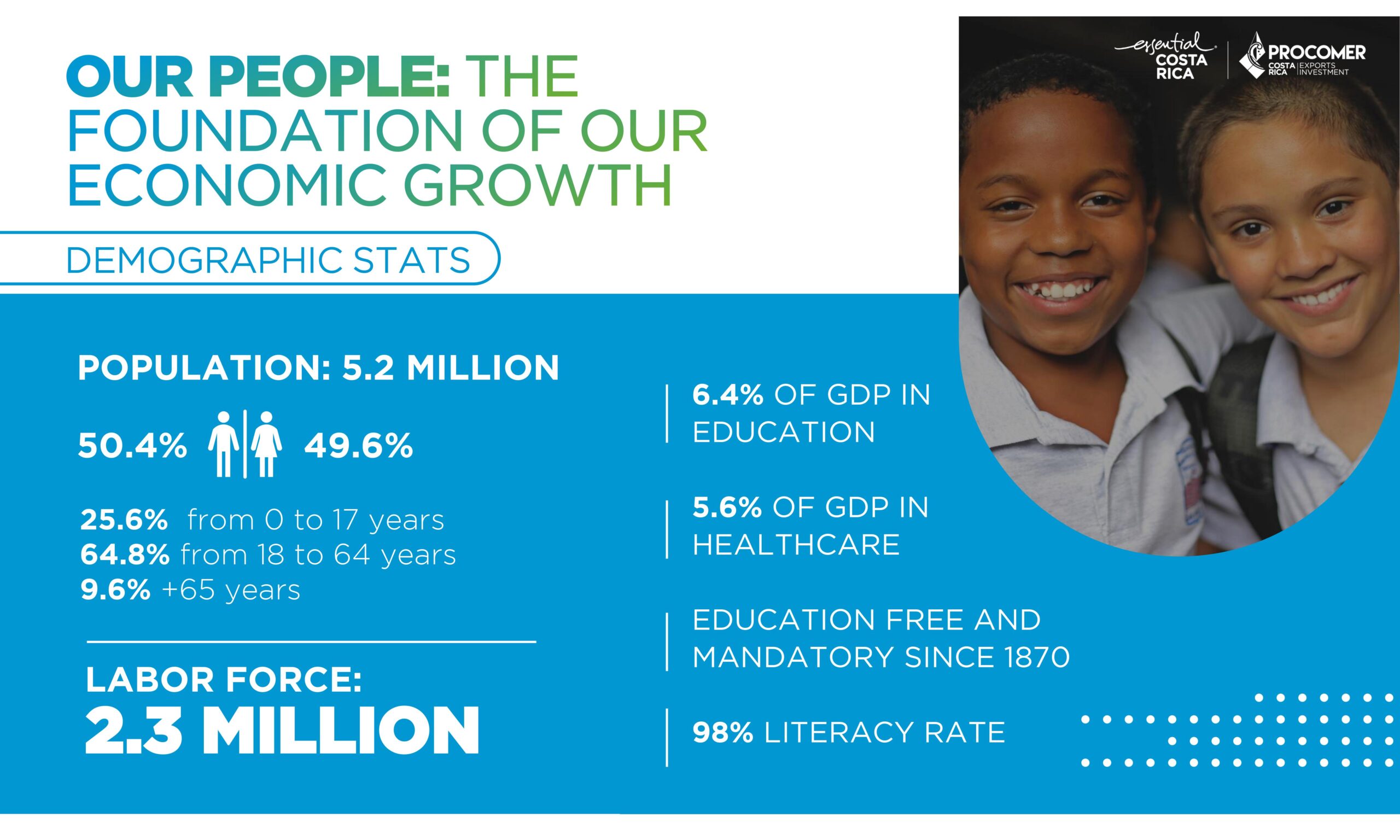

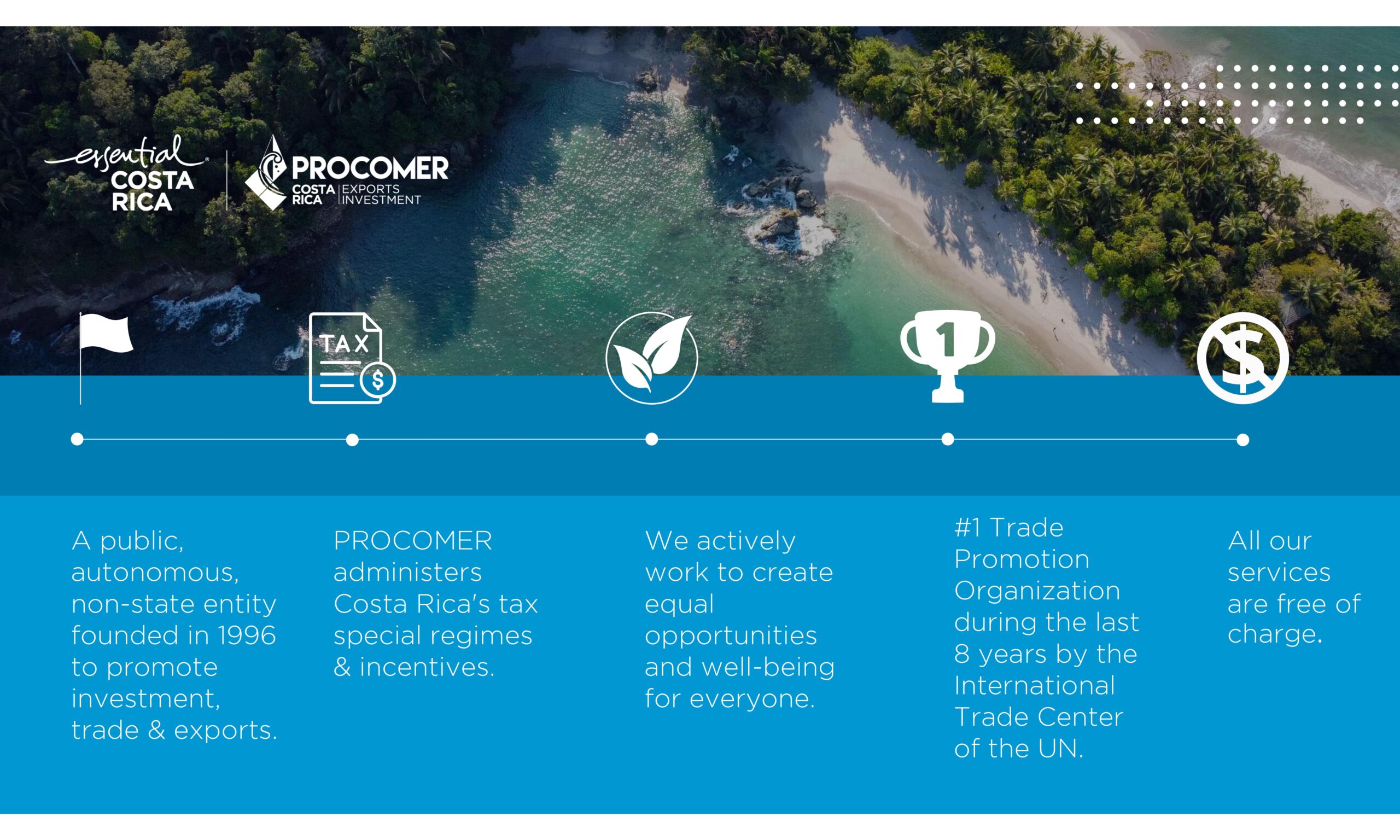

For companies seeking to invest in Central America, doing business in Costa Rica is an excellent choice. Over the last several decades the Costa Rican government has taken measures that have made this nation of just under five million inhabitants fertile ground for foreign direct investment (FDI).

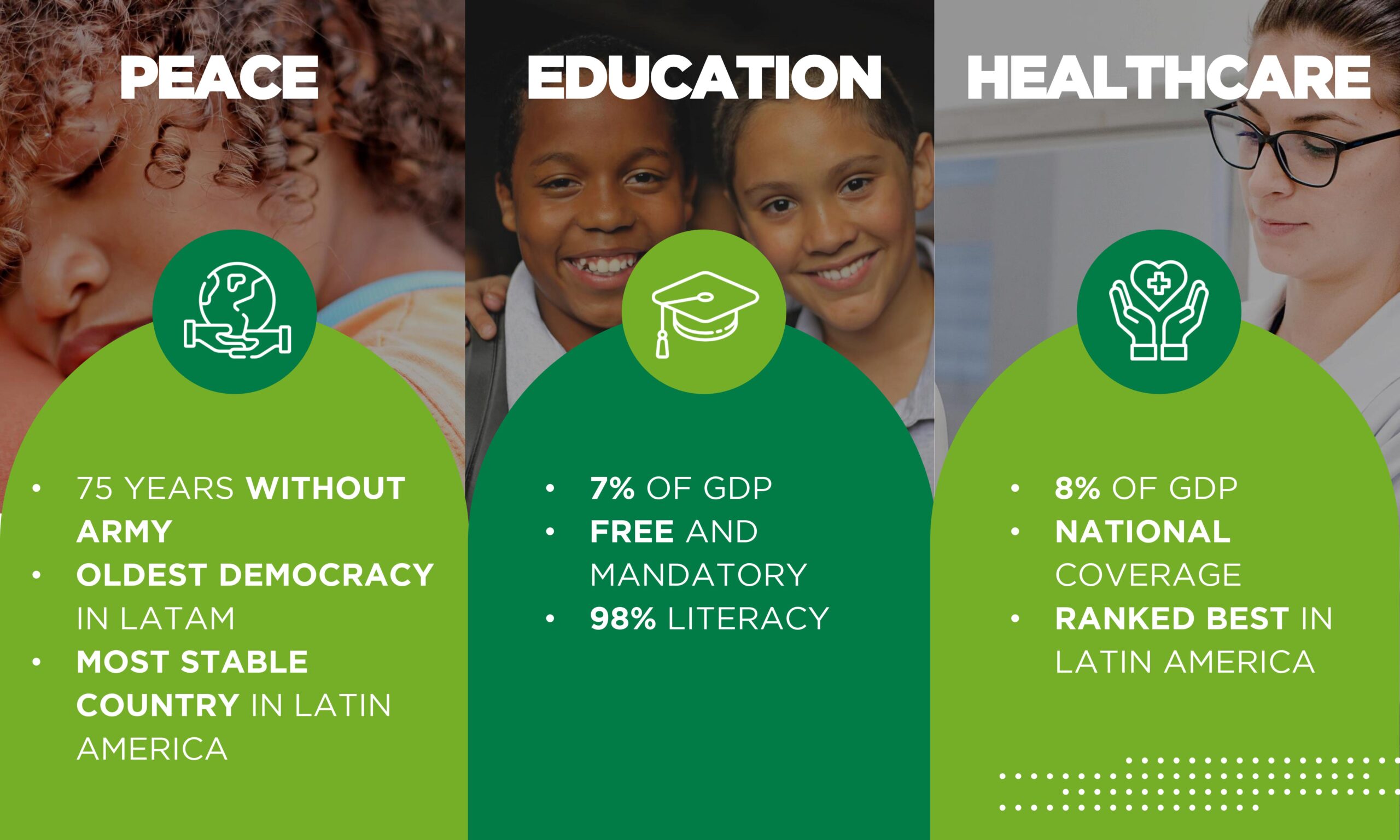

As a result of efforts to make doing business in Costa Rica attractive to foreign firms, the country has positioned itself as one of the leading homes in Latin America for companies in industries such as advanced manufacturing, aerospace, electronics, light manufacturing, medical devices, and pharmaceuticals. One of the main factors that make doing business in Costa Rica advantageous is that the country is home to a literate and trained workforce. With a 98% literacy rate, workers in Costa Rica are well prepared to engage in high precision and innovative manufacturing, as well as in high-quality services. Costa Rica earmarks 8% of its national budget for education with the goal of educating its citizens to hold positions of high technical skill requirements that are in high demand.

Doing business in Costa Rica enables firms to produce products for the global marketplace. Today the country’s industries export more than 4300 products to over 150 nations worldwide. The government of Costa Rica has been successful in transforming the country into a global export platform by entering into free trade agreements that

give Costa Rican products access to two billion potential customers as well as to 66% of the world’s GDP.

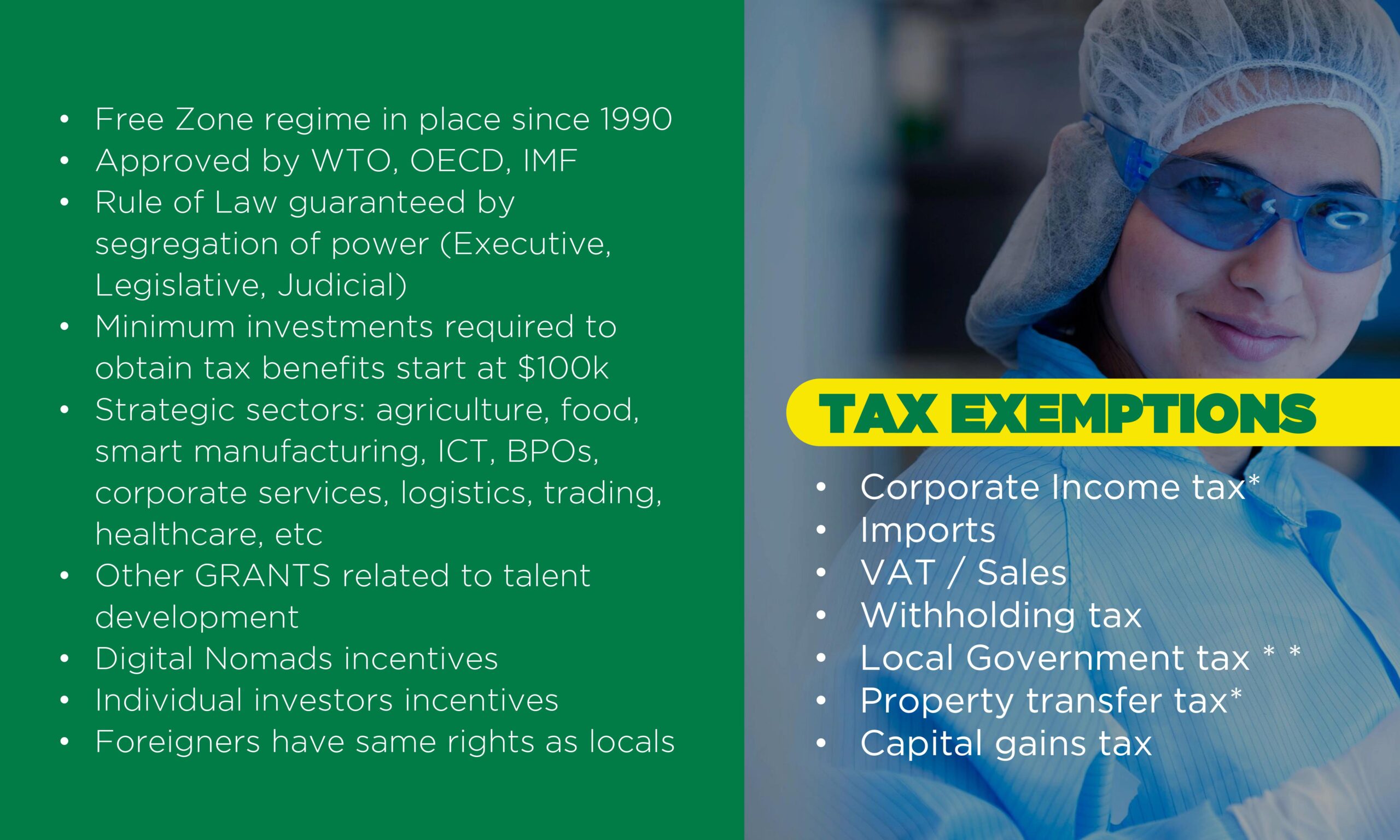

Within this context, companies that are interested in doing business in Costa Rica should take advantage of making their manufacturing investments at the Central American Group’s Green Park Free Trade Zone. Companies that operate at this ecologically sustainable facility must commit to making an investment of US$150,000 in fixed capital.

As a result of making or exceeding this financial threshold, companies that engage in activities such as the manufacturing, processing, maintaining and repairing, and distributing goods are eligible to receive an income tax exemption of 100% during the first eight years of operation. During the subsequent period of four years, firms meeting the specified criteria enjoy an income tax exemption of 50%. For the entirety of the life of the project tax exemptions are available for the importation of any fuels, oils, and lubricants required for the operation, as well as for all taxes on the importation or exportation of products used in manufacturing processes. This includes raw materials and machinery.

Firms that are that are interested in doing business in Costa Rica should contact the Central American Group by filling out the form at the foot of this page.

A sample list of active companies in Costa Rica

Automotive

AGM

(USA) 1995

Bridgestone

(Japan) 1967

Daewoo Bus

(S. Korea) 1995

Deshler Automotive Products

(USA) 2008

Firestone Industrial Products

(Japan) 2009

Hutchings Automotive Products

(USA) 2004

Innovative Components

(USA) 2005

Proquinal

(Colombia) 2004

Distribution

Q-Source

(USA) 2000

Future Electronics

(Canada) 2014

Thermofisher Scientific

(USA) 2011

VWR

(USA) 2013

Engineering & Repair

Teradyne

(USA) 2000

Ingram Micro

(USA) 2012

Medical and Biotech

Boston Scientific

(USA) 2004

Abbott Vascular

(USA) 2010

Medtronic

(USA) 2011

Baxter Healthcare

(USA) 1987

Essilor

(France) 2015

Bayer

(USA) 2012

Clean Tech

Aqua Imara (SN Power)

(Norway) 2009

Windpipe Corporation

(USA) 2012

Valu Shred

(Canada) 2012

EcoPlastic Solutions

(USA) 2014

Engineering, Design, Software

National Instruments

(USA) 2010

Twin Engines

(USA) 2006

Altanova

(USA) 2008

Avionyx

(USA) 2005

Emerson

(USA) 2008

Intel EDC

(USA) 2011

Intel Megalab

(USA) 2014

Intel R&D

(USA) 2015

Metal Work

Refameca

(Venezuela) 2012

UTITEC Inc.

(USA) 2005

Daniels Manufacturing

(USA) 1992

Indian Global Manufacturing

(India) 2014

Oberg Industries

(USA) 2002

Okay Industries

(USA) 2012

Olympic Machining

(USA) 1996

Techspray (ITW)

(USA) 1986

Consumer Electronics

Vitec / CPP

(UK) 1986

Matthews International

(USA) 2015

Noxtak

(Netherlands) 2015

Panasonic

(Japan) 1966

Saco International

(USA) 1995

Electronic Components

Samtec

(USA) 2006

Smiths Interconnect

(UK) 1997

Vishay 1989

(USA)

Controles de Corriente

(USA) 1997

Bourns / Trimpot

(USA) 1979

Electrotechnik

(USA) 2009

Huber+Suhner

(Switzerland) 2008

RDF Sensors Group

(USA) 2006

Semiconductors

Triquint/Qorvo

(USA) 1996

Contract Manufacturing

General Microcircuits

(USA) 2010

Micro Technologies

(USA) 1999

Irazu Electronics

(USA) 2001

Tico Electronics

(USA) 1995

Zollner Electronics

(Germany) 2013

Camtronics

(USA) 1992

ClamCleat

(UK) 2012

Electronics Assembly

Eaton

(USA) 1963

General Cable Corp

(USA) 1971

Havells Sylvania

(India) 1966

Telecommunications

L3 Communications

(USA) 2001

Panduit

(USA) 1994

Promitel

(Columbia) 2012

Suttle

(USA) 1989

GNFT

(Spain) 2011

What makes Costa Rica unique?

Little

Amazonas

Costa Rica’s Marvels of Fire

An Indigenous Legacy that is still a mystery

A Paradise for Divers

An Old Survival Ritual

Guayabo: A glance of Costa Rica’s indigenous past

Natural Touch

The canopy tour, originally from Costa Rica

Costa Rica a favorite country for surfing

A perfect whale’s tail

The secret to longevity is hidden in Costa Rica.

A volcano almost in a capital

Reach Business Success!

Interested in Costa Rica?

This whitepaper addresses:

- starting a business in Costa Rica;

- labor market regulations;

- trading across international borders;

- dealing with construction permits.

You can use this form on the side to download it.