New Investment in Central America can come from Asia

Table of Contents

Contact the Central American Group to establish a nearshore operation in one of the company’s free zone in the region.

The region has advantages in that it seeks to attract investment in Central America from manufacturing industries that are leaving Asia.

The Central American isthmus has enormous potential to attract investment that seeks to establish itself in countries that are geographically close to the United States.

A movement toward more nearshoring accelerated as the coronavirus pandemic contributed to a historic logistics crisis that cost global trade billions of dollars. This is, however, not entirely a new trend but rather a phenomenon resulting from a significant deterioration that has characterized the US-China trade relationship in recent years.

Good air connectivity, congruent time zones, relative proximity that is conducive to ocean shipments, and a long commercial relationship are points in favor of the isthmus’ effort to capitalize on opportunities to receive greater investment in Central America.

The IDB is optimistic

According to estimates by the Inter-American Development Bank (IDB), Central America and the Caribbean have an enviable profile for attracting capital from Asia, but they are not the only ones. Other economies, such as Mexico and Brazil, offer favorable conditions to receive it. Several regions in the Americas are open to competition to capture this new flow of investment.

The president of the IDB, Mauricio Claver-Carone, said at the Summit of the Americas this past June 2022 that both the public and private sectors can coordinate efforts to attract investment and create jobs. The summit, in fact, included dialogue with more than 100 companies. Among them were GAP, Citibank, Amazon Web Services, and Microsoft.

Several weeks ago, Ernesto Torres Cantú, CEO of Citi Latin America, also analyzed the region’s opportunities and challenges and highlighted that nearshoring is one of the opportunities.

Torres Cantú also said that a decision of this type is long-term and reiterated that when a company looks for where to invest, once they have made the decision, it will not change in 10 or 20 years. According to him, investment in Central America is a good option for companies that are seeking to locate operations in closer proximity to home.

Opportunities for investment in Central America

The region’s countries move at different rates to consolidate the arrival of fresh capital investment that also promises to generate employment.

The Guatemalan government, through the country’s Ministry of Economy, announced in June that it is working on developing a new law to grant incentives for companies that relocate their investments to the Central American nation.

Guatemala is the sixth country with the most potential to increase its exports from nearshoring in the region of the Central American Integration System (SICA). The leading countries are the Dominican Republic and Costa Rica. According to IDB estimates, Guatemala can potentially increase its exports by more than US$780 million due to the arrival of new companies or reinvestments.

At the beginning of the year, the Vice Minister of Economy of Guatemala, Lizardo Bolaños, explained that his government’s investment attraction strategy is focused on sectors such as pharmaceutical products, medical devices, manufacturing, electronic equipment, call centers, and BPO. He added that there are joint public and private efforts to make foreign investors aware of the opportunities for investment that exist in the country.

“The international environment is ready to take advantage of relocation or nearshoring investment in Central America to reach markets faster, regardless of what the investment climate in Asia may be,” he said.

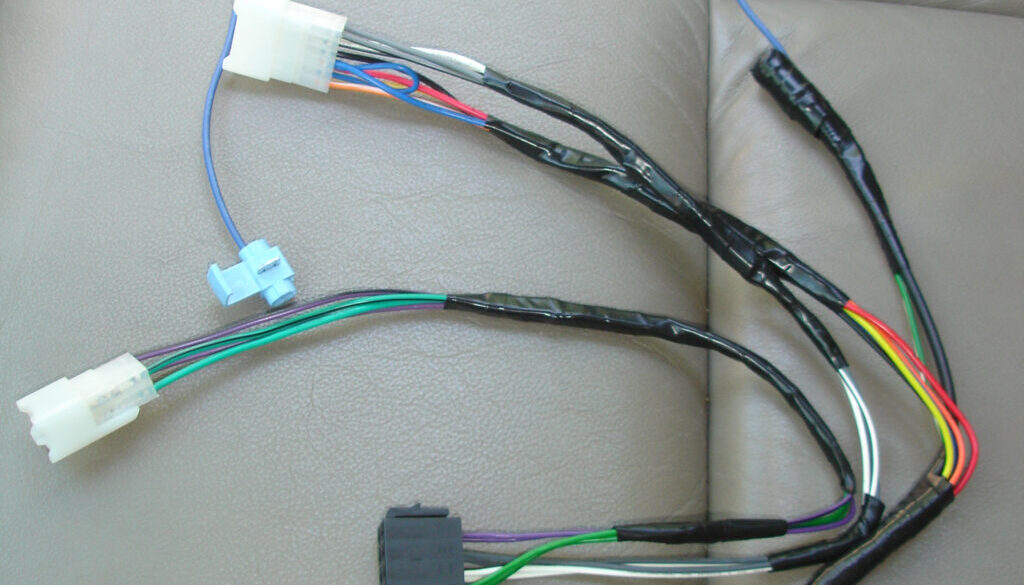

The strategy has begun to bear fruit. In recent months important investments have been announced for the manufacturing sector. Among these is Yazaki North America, which announced investments to establish two new harness production factories in Guatemala.

The firm participates in the Call to Action initiative promoted by US Vice President Kamala Harris. This effort aims to promote job creation and stop illegal migration to the United States. Yazaki already has factories in El Salvador and Guatemala. With the expansion of its Guatemalan operation, it seeks to create a regional cluster to manufacture the harnesses that are the wiring that the automotive industry incorporates into the electrical systems of motor vehicles.

Along with Yazaki, other manufacturing companies have heeded the call of the Harris initiative to participate in investment in Central America. Other companies that have responded positively include Unifi (manufacturer of synthetic threads), which will reinforce its investments in El Salvador, and SanMar, a US clothing wholesaler. The latter company has announced that it will increase its purchases from suppliers based in Central America to US$500 million by 2025. Gap Inc., the clothing brand, also stated that it will increase its supply in the isthmus by US$50 million annually until 2025. Finally, Agroamérica highlighted the fact that it will inject US$100 million into six projects that will be installed in the Northern Triangle of Central America. Among these efforts, the production of bananas and avocados stands out.

Impacts of investment in Central America

At the Summit of the Americas, the IDB presented estimates of the impact of nearshoring in Latin America. The region has the opportunity to capitalize on US$64,093 million in new exports, of which Mexico has the greatest potential at US$35,278 million. This is against the US$7,638 million it can offer to Central America and the Dominican Republic combined.

Elisa Suárez, former president of the Panamanian Association of Executives, said that in her country, the authorities had enacted a series of regulatory frameworks and measures that encourage the establishment of agro parks, manufacturing centers, and headquarters of multinational companies. She also pointed out that “establishing a pharmaceutical cluster that not only distributes products in the region but also manufactures locally supported by local value chains, has potential as an investment.”

Hugo Maul, an economist at the Center for National Economic Research (CIEN) in Guatemala, is optimistic about the opportunities but also advises caution.

“I applaud (the efforts), not without realizing that we are making a conceptual error because relocation is based on the premise of having a more reliable supply chain. It is not just about putting the factory that produces in the backyard of the US, but that the inputs can be produced regionally, “he said.

The researcher reiterated that as a region, the Central American countries compete to attract these investments, but, in many cases, this can be done without taking advantage of complementarities. “If electronic components require materials from Asia or coils from another country, it’s not that easy to get them. The supply chain is still vulnerable, and in practice, it is difficult to solve the problems we have as a region”, he pointed out.

However, he believes that there are opportunities to evolve to attract investment in Central America through more sophisticated industries. This can be done by replicating the integration that the textile industry already has demonstrated in the region, which now has the potential to increase its economic relevance in the isthmus.

Contact Us

Please use this form to contact us and we will respond as soon as possible:

Contact Us

Please use this form to contact us and we will respond as soon as possible:

Contact Us

Please use this form to contact us and we will respond as soon as possible:

Contact Us

Please use this form to contact us and we will respond as soon as possible: